CARES Act Summary

- Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed on March 27, 2020.

- The CARES Act is not a stimulus but a relief. What is the difference?

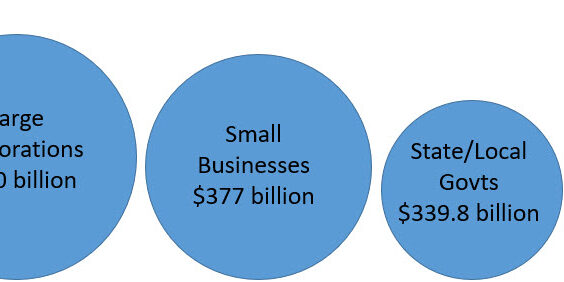

- Allocation of the $2.2 trillion across individuals and businesses.

The CARES Act bill is a $2.2 trillion relief. The timing of the CARES Act bill was passed in lightening speed. It was passed within two weeks time and approved by President, Donald Trump on March 27, 2020. “It went through 10 rounds of revisions in just six days,” says Nicole Kaeding, VP of Policy and Economist for the National Taxpayers Union Foundation on a Forbes podcast.

A stimulus is a concept from Keynesian economics which is the idea to give consumers money to spend. As the consumers spend, it will increase the aggregate. In the current events of COVID-19, consumers do not have access to spend as they typically would. Shopping malls, bowling allies, movie theaters, hotels and travel are off limits at this time. So how are these affected businesses protected?

The CARES Act is not trying to boost aggregate demand but rather provide relief to ensure businesses don’t have to lay off as many employees. Protecting jobs. From there, those who are unemployed can also receive assistance to make sure the rent and bills are paid. Overall, the CARES Act is not a means to grow the economy but rather protect it from sliding backwards.

CARES Act Explained

Recovery Rebates $1,200 pp / $500 pc

$1,200 per person and $500 per child payments will be direct deposited. Individuals who made up to $75,000 gross will receive the max payout of $1,200. The amount incrementally decreases but continues to pay out to those making up to $99,000 gross. $500 is paid per child in the household. If you have yet to file 2019 tax returns then your 2018 tax return will be used to determine gross income and dependents.

The money is being distributed quickly thanks to direct deposit. If you are not of the 60% of Americans who have direct deposit setup with the US Treasury (ie. direct deposit from filing previous federal tax returns), a check will arrive in the mail. The direct deposit method will come in three weeks and the traditional mailing of a check can take up to six weeks.

Borrow Up to $100,000 from 401k

Prior to the CARES Act, retirement plan loans were capped at $50,000 or 50% of the vested balance. From March 27, 2020 and for the following 180 days, retirement plan loans are capped at $100,000 or 100% of the vested balance. For any existing retirement loans, payment through December 31, 2020 can be deferred for one year.

Loans to Small Businesses

Apply to the Small Business Administration to receive a loan to help make payroll for several months. These loans will be forgiven if certain criteria are met. $360 million of the $2.2 trillion is dedicated to small business loans over the next several months. This amount will be expanded as needed.

Unemployment Insurance Expanded

Unemployment insurance payments have been boosted by $600 a week for the next several months.

“As workers across the country make sacrifices to combat the coronavirus, the U.S. Department of Labor is focused on supporting them and their families during a time of economic hardship,” said Secretary of Labor Eugene Scalia. “The Department is offering guidance and support so that States can provide benefits quickly while protecting the integrity of the unemployment insurance system.” -Department of Labor

Changes to other loan provisions and expanding funding for health care providers are in effect also. For large companies, interest deductions were expanded from 30% to 50% for the 2020 tax year.

Employer Payroll Tax Liabilities Delayed

For businesses, the employer-side payroll tax is delayed up to the end of 2022. Changes took place around net operating losses, interest deductions, and income tax base provisions. As a small business, if you accept the above loan then you are not eligible for delayed payroll taxes through 2022. These payroll tax delays may be more beneficial to larger corporations.

The CARES Act bill is a $2.2 trillion relief. For context, the federal government was going to spend approximately $4 trillion in total for 2020. This $2.2 trillion relief bill is a significant increase in federal spending in one year. Thankfully, interest rates are fairly low at this time for the federal government. This is thanks to bond markets giving the leeway. A copy of the CARES Act can be located at congress.gov or here.

COVID-19 Updates with Profiles

Profiles continues to monitor the current business and economic climate. Stay updated through our Coronavirus Updates as we continue to provide digestible content on hiring, job searches, working remotely, and other relevant topics.